In the dynamic landscape of the med spa industry, where client satisfaction and financial sustainability are paramount, business owners often find themselves contemplating ways to maximize profits without compromising service quality. One strategy that has gained attention is the practice of passing credit card transaction fees on to customers. While the decision requires careful consideration, it can be a savvy move when executed thoughtfully.

Understanding Credit Card Transaction Fees

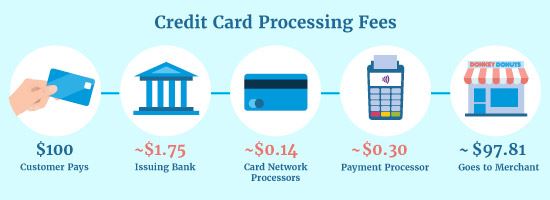

Before delving into the strategic aspects of passing on credit card transaction fees, it’s crucial to understand the nature of these fees. Credit card companies charge businesses a processing fee for each transaction, typically ranging from 1.5% to 3%, depending on the card type and payment method. For med spas that frequently process high-value transactions, these fees can accumulate, affecting the bottom line.

The Balance Between Customer Experience and Profitability

Customer experience is the backbone of any successful med spa business. Clients seek not only effective treatments but also a seamless and enjoyable experience from start to finish. Implementing a credit card transaction fee requires a delicate balance to ensure that it doesn’t negatively impact customer satisfaction.

Transparent Communication: Open and transparent communication is key when introducing any changes to pricing structures. Clearly communicate to your clients why this adjustment is necessary, emphasizing the benefits they will continue to receive from your med spa services.

Value Addition: Reassure clients that their experience remains a top priority. Emphasize ongoing investments in cutting-edge technology, skilled professionals, and enhanced amenities to justify the quality they expect from your services.

Assessing the Financial Impact

Calculating the financial impact of passing on credit card transaction fees is essential. Conduct a thorough analysis of your transaction volume, average transaction value, and the types of cards most commonly used by your clients. Understanding these factors will help you gauge the potential increase in revenue and offset any potential decrease in customer satisfaction.

Consult with Financial Experts: Before making a decision, consult with financial experts who specialize in the med spa industry. They can provide insights into the potential impact on your business’s financial health and offer guidance on optimizing the strategy for maximum benefit.

Implementing the Strategy

Once you’ve decided to pass on credit card transaction fees, it’s crucial to implement the strategy seamlessly. Here are some steps to consider:

Update Policies and Procedures: Revise your business policies and procedures to reflect the new approach. Clearly outline the details of the credit card transaction fee, including when and how it will be applied.

Train Staff: Educate your staff on the changes and equip them to answer client queries confidently. A well-informed team can effectively communicate the reasons behind the adjustment and address any concerns.

Utilize Technology: Leverage technology to automate the calculation and application of credit card transaction fees. Implementing a streamlined system ensures accuracy and efficiency in the billing process.

Managing Customer Perception

Mitigating any potential negative reactions from clients is crucial to maintaining a positive brand image. Here are some strategies to manage customer perception:

Educate Clients: Offer educational materials explaining the industry-standard practice of passing on credit card transaction fees. Helping clients understand the broader context can foster acceptance.

Provide Alternatives: Offer alternative payment methods that carry lower or no transaction fees. This allows clients to choose a payment option that aligns with their preferences and potentially reduces resistance to the new policy.

Final Thoughts

While passing on credit card transaction fees is a strategic move to bolster profits in the med spa business, it’s essential to approach the decision with care and consideration for customer satisfaction. By maintaining transparency, justifying the decision through continued value addition, and implementing the strategy thoughtfully, med spa owners can navigate the delicate balance between profitability and client experience successfully. As with any business decision, ongoing evaluation and adaptation are key to ensuring sustained success in the competitive med spa industry. To see how much money you could be potentially saving, contact us for a FREE merchant processing evaluation today!